Asset management

Asset allocation | Neutral

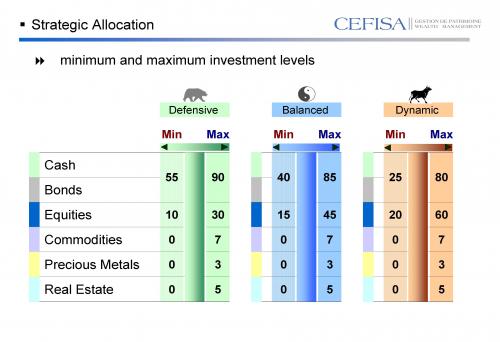

First we defined three risk profiles based on the maximum portion in equities:

Defensive – Balanced – Dynamic

Each profile is a Neutral Allocation (benchmark) which includes, in predetermined proportions, the six major asset classes:

Cash – Bonds – Global Equities

Commodities – Precious Metals – Global Real Estate

Asset allocation | Strategic

Our model compares these six asset classes and ranks them. On the basis of this ranking we are developing our Strategic Allocation by allocating to each asset class, with the exception of Bonds and Cash, a level of investment:

Minimum or Maximum

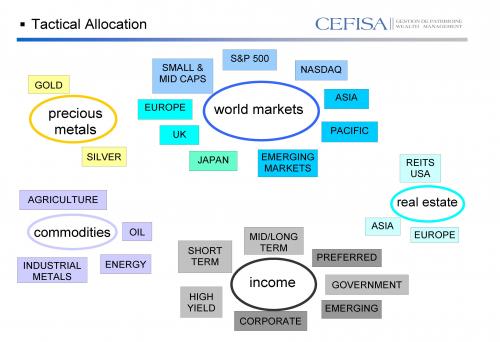

Asset allocation | Tactical

To optimize performance, we refine our choice within each of these asset classes in the strategic allocation to establish a Tactical Allocation. The choice of the underlying assets follows the same method for comparing various underlying of the same asset class between them.

Asset allocation | Strengths

- Our model is based on a method of quantitative analysis that excludes any subjective interpretation of data

- We optimize performance through active management of the asset allocation, with the exception of Cash and Bonds, using only two investment thresholds: minimum or maximum

- Implementation of the allocation in the portfolios of clients is very simple because our models incorporate easily tradable ETF representing various asset classes or underlying asset

- Rules and presets for the development of our asset allocation can be adapted to any customer requirement

Contents

Philosophy

Methodology